Dear Friends,

I need to explain this to someone. It seems as though no one really understands this number game. Everyone says it’s so good that I’m working, that I’m a good Mum, that I’m not just a welfare mother, how clever I am, what potential I have blah blah blah – bullshit.

If I’d stayed married, things might not be any better. X’s vision was for me to go and clean nursing homes while he stayed home and played his guitar while the babies screamed in the background. I can’t castigate myself now for leaving that marriage.

The second piece of irony – and this one stings – I’ve finally found a job I like and can do, with people I can respect, who respect me. I actually like my job and enjoy it.

What’s so soul-destroying is the numbers game which holds me hostage. And yes – I did blow my entire income tax return last year by going overseas. Again, I get all kinds of messages about how that was a great thing to have done: “It’s the first thing you’ve done for yourself in all these years, and it’s about time you had a holiday.” Bullshit. People like me don’t deserve to go on holidays. We should stay in our little holes and not bother anybody.

Am I profligate with my money? Could I – should I – manage it better? I honestly don’t see how. Food and bills are all I spend it on – the absolute bare minimum basics. I work 18.38 hours each week. If I didn’t go out to work, I might not have more money to spend, but I also would have fewer commitments that demand that I spend money on them. If I have to pay for all-day parking once each week, I earn almost nothing over and above what I’d be getting on welfare alone.

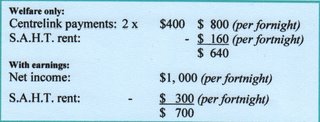

Here is how it works.

I go out to work in a 0.5 fractional position at HEO3 level rates. (It’s an entry-level position. What do I expect – I’m a single mother, unprofessional, at least it’s not a casual job!)

Each fortnight, my pay slip tells me I’ve earned around $600, for which I am taxed $200. About $400 is deposited into my bank account. However, I have to report my gross earnings to Centrelink, who reduce my welfare payment. For the $400 net I earn each fortnight after tax, Centrelink takes another third, leaving me with about $200 in net earnings.

Now, I am extraordinarily lucky to live in government housing. (Imagine if I had to pay private rent?) In addition, because I was clever enough to flee my marriage in 1993, even though it took 14 years to be housed, legislation states that I cannot now be kicked out of my home (which, I have to acknowledge, has got to be a good thing). And I thank my lucky stars each and every day that I live in meek old Adelaide, where “the cost of living” is so very low. Here’s the thing: because I am in government housing, I am not eligible for rent relief from Centrelink.

Rent relief may be a non-issue, but the scaled rental payment for which I am liable each week is significant. If I had nothing but Centrelink payments, I would pay about $80 each week to live in this house. However, because I earn the exorbitant amount of $600+ each fortnight (yes – Housing Trust works out my rental payment according to the gross amount, as does Centrelink), my rent has almost doubled. I pay $151.50 each week.

The difference (I’ll work that out for you) is $71.50 per week. That $71.50 is money that I have earned by going out to work. It is the money I owe the government for living in government housing and earning outside of the government welfare system. It is money over and above the (reduced) Centrelink payment I am handed each fortnight for being a single parent, and it is money over and above the money that is deducted in tax from my pay each fortnight.

Now actually, I receive two Centrelink payments. On the week in between, I receive about $400 for the parenting payment. So my total fortnightly income consists of:

Looks pretty good, doesn’t it. $1,400 per fortnight – that’s $700 per week, for goodness sake. If I can’t raise two teenagers on that amount, there must be something wrong with me. What do I expect – larger government handouts?

Remember, that’s not the real picture. It is, however, the picture that Centrelink, the Housing Trust, the Smith Family and the Salvation look at Army (believe me – I’ve been pushed to beg more than once before, for my groceries).

But I have to explain this to someone. So here’s the real picture:

So that is actually only $500 per week to raise two teenagers. From this amount comes rent, food, petrol, school fees and everything else.

If we take a look at the rental situation in a similar light, it only gets worse.

Here’s how it would be if I didn’t go out and earn.

OK, so I’m $60 in front! Whoopeedoo! What’s the story? Why am I complaining? Why am I depressed? Why am I feeling trapped and in despair? Why don’t I go out and spend that extra $30 each week – live it up, treat myself to something nice?

Let’s look at it another way. If, after all that, I am only $30 per week in front of my welfare entitlements, and I am working 18+ hours each week, that means I am working for the grand sum of $1.66 per hour.

And for that extra $30, I get to be productively occupied with something other than parenting!

So what would I be doing with my time if I didn’t go out to work? I might still be depressed and in despair. I might long to have my days filled with some kind of meaningful productivity other than keeping house. I might have written my novels by now. I might have time to op shopping for the essentials I am forced to buy new, because I don’t have time to op shop, and because my children and I live with the pretence that as a working single mother we can do better. Who knows? It might not be any better. But does that make what we have, all right?

The solution? It’s not my employers’ fault. I knew when I applied for the job, that it was only an HEO3 half-time position. And yes, I probably will get a chunk of this money back at the end of the financial year. (I can see by my payslip that I have already paid $3,238.00 in tax.) But that doesn’t help me pay the bills I have right now. My creditors are not going to be willing to wait for August or September on my promise that I will pay them if and when I get the money back from the government.

I’m bitter and I’m sad. I’m in despair. I see no way out. It’s not a pretty picture.

We aren’t starving. We never will. We have a roof over our heads. We have a car to drive around in. We have furniture to sit on, beds to sleep in. We have so much, yet we have so little.

The solution? Again, it’s a tough one. Obviously, I need to work longer hours, and/or I need a higher-paid position. I cannot begin to calculate what will happen when my son goes onto Youth Allowance in May. That just frightens me even more. I intend to finish my graduate diploma in Education, by taking leave without pay from my job for 5 weeks in May/June, after which I will be qualified to teach. When I did that last year, we managed quite well without any extra income (this should come as no surprise, if you’ve managed to follow what I’ve written here). In the meantime, it is unlikely I’d find a higher-paid job for the next three months that would let me go on leave for five weeks, so I guess I keep on treading water for that $30 per week and believing everything will be all right. Do I want to teach? Not really – I like my part-time office job – but I don’t think I can afford the luxury of choice.

Forgive me if my attitude at work seems deficient. I know it’s not your fault I’m working for $1.66 per hour, but somehow, that doesn’t make me feel any better. I promise to go on doing my best. This is the best I can do.

Yours truly,

Melina Magdalena

P.S. Please note that I have rounded figures both up and down in the above diatribe, which balances itself out, in the end. After all, numbers are just numbers. We’re just one small family trying to make ends meet. And we’re the enemy – the greedy, unscrupulous, welfare dependent ne’er do wells that Australia loves to vilify, and who do not deserve to be heard. However, I am audacious enough to expect, await, and look forward to your response.

© 2006